Predicting Elon Musk’s behavior is a mug’s game, but for all its cultural importance, Twitter has had a notably undistinguished life as a public company. The focus over the last 24-hours is to see whether Musk can do things so it fares any better as a private one. But the cart feels way ahead of the horse here. I think a lot more is going on.

26 April 2022 – Well, that was pretty damn quick. Over on my Twitter timeline today, people were going wild with the most definitive, histrionic takes on Musk’s acquisition will mean for the user experience. Twitter is about to be overtaken by trolls and harassers; Twitter is about to re-learn 10 years’ worth of lessons about content moderation the hard way; Twitter is about to see an employee exodus like none we have ever seen. And so on.

Flashback: Twitter originally welcomed Musk into the fold, offering him a board seat when he disclosed a 9.2% ownership stake. Then Musk changed his mind and launched his takeover effort. Twitter turned cold, adopting a defensive measure – a poison pill.

What changed? Musk’s announcement last Thursday that he’d secured financing for his bid, via a combination of his own cash and debt from Morgan Stanley, seems to be the factor that turned the tide. Before that, Twitter’s board could fall back on the argument that Musk’s talk was bigger than his walk — like when he tried taking Tesla private in 2018. But we might never know exactly what happened behind the scenes (we’ll need to wait for somebody’s memoirs), but Twitter’s board capitulated.

And so Twitter’s board had a choice: continue to fight Elon Musk or take the path of least resistance. It picked the latter, declaring victory and going home. Look: Twitter is a tough business to manage, with critics at every turn. The board decided to make it someone else’s problem.

Interestingly, Musk never raised his price. Also, Twitter was unable to secure a “go-shop” agreement, which would have allowed the company to solicit superior bids. And on this last point, I need to give a lot of credit to Cassandra Este, my in-house financial analyst, who helps me plow through 10Ks, S-1s and all manner of financial statements . She ran the Twitter numbers and told me:

There was speculation about alternative offers for Twitter. What seems clear is that those alternative offers did not materialize, and the most obvious reason why is Twitter’s anemic cash generation. Twitter’s free cash flow from operating activities was $630 million in 2021, and has averaged $976 million annually for the last three years. This matters because leveraged buyouts (LBOs) depend on free cash flows; typically in an LBO:

• An acquirer borrows the money necessary to take a company private.

• The company’s free cash flows are used to cover interest payments while the now-private company is restructured and rebuilt.

• The repackaged company is brought back to the market via an IPO, which provides the funds to pay back the principal (and provide a profit).

Assuming that a Twitter LBO was 90% debt and 10% equity, matching Musk’s offer would require $4.4 billion in cash and $39.6 billion in debt; if we were generous to Twitter and assumed $1 billion in free cash flow, that would necessitate an interest rate of 2.53% just to cover the interest payments. However, interest rates for BBB-rated debt — speculative but investment-grade — are at 4.51%. That would limit borrowing to only $22 billion (I don’t actually know what grade Twitter debt would be, but the point holds regardless).

In short, there was no white knight for the board. But let me summarize the deal so you see how strange it is:

• $13.5 billion of Musk’s offer is a loan to Twitter; the aforementioned 4.51% interest rate would mean $609 million in annual interest payments, which, you will note, was just covered by last years free cash flow of $630 million.

• That leaves $33.5 billion of Musk’s offer as cash for equity.

• $12.5 billion of that cash is a margin loan against Musk’s Tesla stock; $21 billion is out-of-pocket.

The first thing to note is that Musk is taking on enormous risk, and doing so in a way that actually limits his potential return. Remember, most LBO’s entail putting up around 10% of the purchase price, not 72%; the benefit of that approach is not simply less downside risk, but also more leverage to generate a higher return. This certainly lends credence to Musk’s insistence that this acquisition “isn’t about the economics”.

And it doesn’t seem like the board got any operational concessions, like maintaining employee levels or the ban on former President Trump. (Yes, Trump says he will not rejoin Twitter but nobody believes him. Every morning his staff still gives him print-outs of all the previous day’s Tweets of major Republicans, Trump’s fiercest critics, etc.)

During an all-hands employee meeting after the deal was announced, Current Twitter CEO Parag Agrawal and board chair Brett Taylor basically replied to such questions with: “Ask Elon”.

And employee angst is obvious. In the moments just before and just after the Twitter Board announce Elon Musk was buying Twitter, the company Slack channels lit up. It had been days since Twitter leadership had shared anything with them, and after a weekend’s worth of reports that a sale was imminent, employees were looking for answers. As noted by many Twitter employees on both Twitter and Facebook, work all but came to a halt: “it’s like a classroom where the teacher is late and students are attempting to self-govern” one said on Twitter. A “hellhole,” said another on Facebook. One Slack thread forwarded to me, in which an employee asked good-naturedly whether anyone was excited about the prospect of working for Musk, drew dozens of responses – almost all of them quite ugly. Sentiment in the public Slack channels remained largely concerned and negative. I have a godson who works at Twitter and he said “people seem to be just giving up”.

NOTE: one big factor. Many Twitter employees receive half or more of their compensation in stock. At the all-hands meeting on Monday afternoon after the sale was announced they were told that employees will not receive equity once the company goes private. As a result, group chats were scrambling to see if working at Twitter makes economic sense first and foremost. A job board was even set up.

The deal is expected to take around six months to close. What was revealed at yesterday’s all-hands meeting was that CEO Parag Agrawal was likely to leave the company (cushioned by a $39 million payment from selling his Twitter stock in the acquisition). But layoffs were mentioned as well as a hiring freeze, and a partial freeze on new features. But the latter is probably because Twitter doesn’t want to introduce any new bugs. And bots are being purged (many of you may have seen a drop in followers). But that is related to some due diligence for the sale. I bet having millions of fake accounts are a problem so they are deleting like mad.

So hiring will be harder. There will be significant attrition, particularly in the leadership ranks – and one suspects on the “health” teams that work to fight harassment and abuse.

Beyond that, as with everything related to the Twitter-Musk story over the past month, it’s extremely difficult to predict the future. But herein a few thoughts.

In the end, it was just business. Twitter has long been an underperformer, and much of Wall Street seemed relieved that the company now had a real chance to make radical change. As a private company, beholden only to the interests of one man, Twitter may be able to transform itself in ways that it never could while it had to report quarterly earnings.

The $44 billion question, though, is … transform it into what? What is Twitter for? Everybody who’s ever been in control of Twitter has had a different answer to that question. It’s a question that has vexed users since its creation.

There was the era after Jack Dorsey returned to CEO and tried to focus the product’s attention on “what’s happening.” There was the effort led by former chief operating office Anthony Noto to make Twitter a destination for live video. More recently, Dorsey oversaw efforts to both make the company a platform for “healthy conversation” and to turn it into a decentralized protocol.

So what does Musk think Twitter is for? All we have to go on is a series of cryptic tweets and statements that are short enough to allow for wide interpretation. In this moment, he is still a mostly blank canvas on which people can project their hopes (like the Republican members of Congress tweeting “free speech is making a comeback”) and their fears (like those Twitter employees in Slack). On stage at a recent TED, Musk said he didn’t care about “the economics” of Twitter “at all.” But given the way he structured this Twitter deal, he will face pressure (if not insurmountable pressure) to see a return on his investment. Here are Krystal Hu and Anirban Sen at Reuters:

More than two-thirds of the $46.5 billion financing package that Musk unveiled on Thursday in support of his bid for Twitter would come from his assets, with the remainder coming from bank loans secured against the social media platform’s assets.

That is the reverse of how most investors structure buyouts, with debt secured against the assets of the target company typically comprising the majority of the financing.

What is more, Musk has agreed to take out a risky $12.5 billion margin loan, secured against his stock of Tesla Inc , the electric-car maker that he leads, to pay for some of the $33.5 billion equity check. Were Tesla’s stock to drop by 40%, he would have to repay that loan, a regulatory filing shows.

So, to avoid having to sell a bunch of his Tesla stock and pay off his loan, maybe Musk does find that he has to care about the economics of Twitter.

In which case, what does he do? It’s fashionable lately to suggest Musk ought to get Twitter out of the ads business. (Ads are out of fashion in general). But as a feed-based social network, ads arguably still make a great deal of sense for Twitter. When former CEO Dick Costolo embraced ads as Twitter’s future it was because “it was the best way to make the most money. it wasn’t because of an inherent love of advertising.”

The company could place a new emphasis on subscriptions, either by expanding its $2.99 Twitter Blue product or by scrapping it and building a new subscription product from scratch. “Make power users pay for access to their large audiences”, is one idea that keeps coming up that seems plausible to me.

Or Twitter could lean harder into becoming a decentralized protocol, selling API access to enable developers to build a variety of different front-end experiences. That could enable different users to choose different styles of content moderation, while effectively turning the core service into an enterprise software product.

I think any of these outcomes is plausible. But if Musk has a hand, he’s not tipping it. His official statement yesterday bears little evidence that he has thought much about what he will do with Twitter as a business much beyond the close of the deal:

“Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated. I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans. Twitter has tremendous potential – I look forward to working with the company and the community of users to unlock it”.

Perhaps he will develop a stronger point of view, and share it, in the coming months. The thing is ads account for nearly 90% of Twitter’s revenue now, while data licensing provides most of the rest. But Twitter’s ad models are terrible, and part of why it has been so anaemic for years. There are so many possible business models: direct subscriptions, paywalled accounts (you already can’t retweet a locked account, so some of the infrastructure is there), much more targeted advertising, licensing tweets, licensing the “social graph” of who follows who and what topics, and any and all mixtures of those. Musk has proven, at SpaceX and Tesla, that he can attract and manage really good engineers who do remarkable work; Twitter’s team need to prove their mettle now.

NOTE: This morning I was on the AdAge webinar which took a quick look at the deal and Elon Musk’s Twitter ownership is giving advertisers serious pause about the platform’s future, and some brands are asking their agencies for advice on whether to even stick with the messaging platform, according to multiple ad execs. Many believed it threw a wrench into the world of media and advertising, just as Twitter was heading into the key ad sales season known as “NewFronts”. “Fuck,” said one top marketing exec. The expletive basically sums up the feeling among many in advertising: marketers are worried that Musk will reopen the floodgates on uncivil behavior on the platform. Musk is seen as somewhat of a wildcard for brands; the billionaire views Twitter as a “town square,” where speech should be relatively open. But advertisers hope Twitter doesn’t become more like a bathroom stall under his watch. In recent years, Twitter’s leadership has taken a number of steps to help make brands feel somewhat safe on the platform, working with industry groups like the Global Alliance for Responsible Media to set guardrails. Another major ad agency executive, who works closely with Twitter, said that brands were reaching out to the agency yesterday to get a “point of view” on how to proceed on Twitter. “It suggests that advertisers are anxious and are prepared to stop spending,” the agency executive said.

But a bigger question looms over all this: just who in hell is going to run Twitter day-to-day? Musk already leads Tesla and SpaceX and the Boring Company and Neuralink; presumably he will not be spending eight hours a day on Twitter. Agrawal said today he intends to stay with the company “through the close of the deal”. But with a $39 million payout and his prior experience, he can easily move on. Who will Musk trust with his vision for the company? It’s one of the year’s most interesting tech stories.

Maybe all of that is true, or maybe none of it is. At least some of the worries would seem to be justified, based on Musk’s pasts statements. But the cart feels way ahead of the horse here, and in any case predicting Elon Musk’s behavior is a mug’s game. For all its cultural importance, Twitter had a notably undistinguished life as a public company. For better and for worse, it’s now up to Musk to see whether it can fare any better as a private one.

The paradoxes of the information age make the mind swim. The more we are informed, the more we are disoriented. The more we connect, the more we are divided. The more new content there is to consume, the less we are ever satisfied. The faster the network speed, the shorter our attention span becomes. Bits of information provide neither meaning nor orientation. They do not congeal into a narrative. They are purely additive. They are produced in private spaces and distributed to private spaces. The web does not create a public. On the contrary: the informatization of reality leads to its atomization – separated spheres of what is thought to be true. Instead of the basis for a common narrative, truth becomes a subjective projection of those isolated from each other.

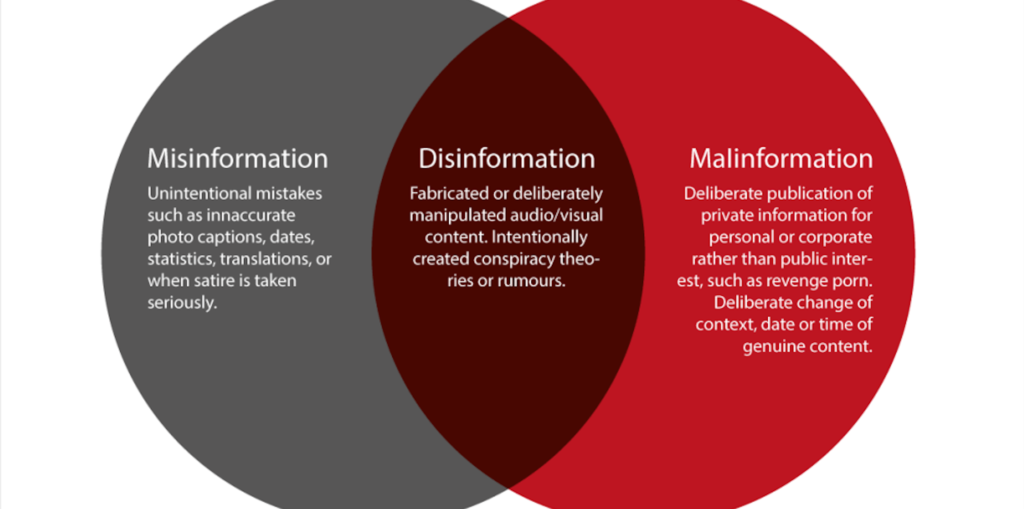

And from a certain point onwards, they no longer inform – they deform. The way information now courses through society is also corrosive. But its exponential, multiplicative and networking power and complexity makes it impossible to manage, control or defeat mis-dis-mal information.

That has been the focus on Elon’s acquisition of Twitter because Twitter occupies a unique niche. Its short chunks of text and threading foster real-time conversations among thousands of people, which makes it popular with celebrities, media personalities and politicians alike. Social media analysts talk about the half-life of content on a platform, meaning the time it takes for a piece of content to reach 50% of its total lifetime engagement, usually measured in number of views or popularity based metrics. The average half life of a tweet is about 20 minutes, compared to five hours for Facebook posts, 20 hours for Instagram posts, 24 hours for LinkedIn posts and 20 days for YouTube videos. The much shorter half life illustrates the central role Twitter has come to occupy in driving real-time conversations as events unfold.

But it also has highly deleterious consequences for the democratic process. Social media intensify this kind of communication without community. You cannot forge a public sphere out of influencers and followers. This fragmentary character of peer-to-peer communication both coincides with and fuels the erosion of those pillars of cohesion that once held communities together.

Twitter has (weakly) held the line and has tried to moderate, and it does offer many the opportunity to counter mis-dis-mal information. But Musk holds himself out as a “free speech absolutist” which leads many to think mis-dis-mal information as well as abuse and hate speech will flourish on the website more than it already does.

I’ll admit, when this saga started I assumed Elon’s intentions were just shitpost performance art. However, the more you look at the “take-Twitter-private” plan in the context of Tesla, the SEC, and the current overall market, it does feel like it’s part of a bigger plan.

Musk going after Twitter is not about distraction; it’s diversification. The past few months have all been Elon putting together the pieces for what’s next, and he’s doing it from a position of strength. I think he is always looking at how his varying business interests will converge in unexpected ways. We just learned Musk was registering properties to make a “super-company” called X Holdings. Why not stick Twitter in that?

I think Twitter is all about what comes after Tesla. What it exactly looks like, I have no idea, but it’s important to at least ask why is this all happening right now. I think the Twitter thing really lit a fire. Maybe Musk was really going to join the Twitter Board and be a cooperative part-owner. But the moment he saw the energy the potential purchase generated, he went all in. Musk buying Twitter has generated the conversational energy that rockets and robots once did.

Last night tech analyst Ranjan Roy wrote that it is about stopping the SEC from interfering with Musk. In September 2018, the SEC charged Musk with making “false and misleading” statements to investors which resulted in a settlement with the government and restricted his use of Twitter (he had to get a Twitter baby-sitter). Through it all, he never stopped Tweeting but was careful in his content. Roy thinks Elon understands his access to Tweeting is existential to every element of his business. Nothing works without his Twitter account. Roy wrote:

It’s conventional wisdom that Musk’s Twitter account transforms the unit economics of Tesla by allowing zero expenses on conventional brand marketing and PR. But the power of his tweeting also lowers his cost of capital, drives corporate partnerships, muscles regulatory pressure, is a recruiting tool, and touches every other element of Tesla, the business (not to mention every other business interest he owns).

Elon understands his access to tweeting is existential to every element of his business. It’s the difference between him being Phil Knight or Michael Dell-rich, to becoming the richest person in the world in nine short months. Nothing works without his Twitter account. My hot take at the time was maybe there was a threat of Musk being deplatformed by the SEC, and this was all pre-emptive. We’ve since learned from analysing all of his Tweets that their timing confirms something very strategic is in the works.

I believe a large part of this is Elon making a move to make sure his Twitter account cannot be limited, and certainly, never banned.

If Twitter is existential to his overall business interests and his account feels threatened in any way, $46 billion for Twitter is a bargain for maintaining, and increasing, his $270 billion net worth.

All great entrepreneurs are always thinking about that next channel of growth. Elon has incredible entrepreneurial instincts, and he has to recognize it won’t come from Tesla. He may not have the same confluence of factors that made him so wealthy.

And here’s the thing – he is already selling Tesla stock. Elon sold $16 billion of the stock last year (some of it would’ve been to pay taxes on options, but he did minimize that bill with a $5.7 billion donation to charities that remain unnamed). It’s not just Elon. His brother Kimbal sold a bunch at $1229 and is now under investigation for insider trading for the transaction.

You can’t blame anyone for selling. When a stock is up 1700% (from Jan 2018) and facing an onslaught of legal, competitive, and internal challenges, it’s certainly okay to take profit.

As Ben Thompson noted last night, look at the entire sequence of events:

The Twitter purchase, the SEC escalation, Tesla’s blowout quarter – it’s all about the next giant package. Musk saw an opportunity at the beginning of the year. Tesla’s business was on a roll, his pay package was almost complete, the SEC was threatening his Twitter account, and Tesla’s stock had stalled out for six months. Every great entrepreneur understands the importance of momentum and he decided to capitalize on this confluence of events.

At first, I was skeptical Musk was serious about buying Twitter, but I’m genuinely starting to believe it’s part of a larger strategy. We’re starting to see more pieces. The potential new “super-company”. He just raised a bunch of money for the Boring Company. Twitter is now both a potentially undervalued financial asset, a political asset, and a marketing tool. I think we may see something incredibly audacious.

So let’s see where we are at. To quote David Rothkopf:

• The richest guy on the 2021 Forbes 400 owns the Washington Post

• Number 2 now owns Twitter

• Number 3 owns Facebook

• Numbers 5 and 6 started Google

• Numbers 4 and 9 started Microsoft

• Number 10 owns Bloomberg

Free speech issues? You decide. Combine this with the Citizens United formula that money equals speech and so those with the most money are entitled to the most speech, lack of campaign finance regulation and politicians who depend on money to hold power and you’ve got a country sinking ever deeper into the quicksand of corruption. So, if you’re just an average American who thinks somehow Musk or some other billionaire is going to enhance the voice of the little guy on the Internet, you are a hopeless sucker who’s not paying attention. And if you think that the trend toward control of public forums by billionaires is not linked to growing inequality and will not produce more of it, more division, more reshaping the narrative to suit those holding the purse strings, you deserve what’s coming.

Rothkopf thinks the greatest looming public policy challenge is going to be creating a “next generation” of regulations that protect society from hate, division, disinformation and corruption. But I think that is impossible. The U.S. social and political systems have been forever changed and they have neither the ability nor the will to “fix” this. The right v. left politics of the media is just a distraction that draws attention away from the rich vs. poor and especially the super-rich vs. everyone else dynamic that really drives U.S. politics. That change is now forever.

And Elon? The true GOAT (“greatest of all time”?) His firm smashed expectations with revenues for the quarter coming in at $18.76bn and net income at $3.3bn, up from $2.3bn in the previous quarter. Tesla’s margins have also increased substantially, by roughly 10%. Their profits far, far exceed the losses. Tesla, a physical car company (not a weightless app), has achieved this rate of growth without any advertising, from word of mouth (us pundits and his). The firm delivered 308,000 vehicles in the first quarter. (By comparison, BMW roughly sells 600,000 per quarter. Five years ago Tesla shipped 103,181 cars in the entire year.)

NOTE: It’s always weird to me how casually news stories drop in the “world’s richest man” detail. Given how journalists fire emoji tweets at length, it still blows my mind that no one has really touched the most rapid accumulation of wealth in human history. Just read this piece from the New York Times in January 2021, and think about it relative to the endless typing taking place over the past few weeks.

And I am not an Elon-hater. I do dislike him, as I do Jess Bezos, because of the wealth they have made vis-a-vis the ill-treatment of their employees. Or my Elon laundry list which my regular readers have seen before:

• On October 31 last year, Musk sent out a tweet which claimed that if the United Nations put forward a proposal to solve world hunger with $6bn, he would contribute the money. Two weeks later, the head of the U.N.’s World Food Program tweeted out a $6.6bn plan to ‘avert famine in 2022,’ tagging Musk and generating major headlines. But, as of February, 2022, the WFP had not received a cent from the world’s richest man. While Musk may not have been convinced by the UN plan, it came as little surprise to me that a billionaire chose not to donate a huge chunk of his wealth to help solve world hunger.

• When Covid hit the United States, in March 2020 Musk tweeted that, ‘SpaceX is working on ventilators too.’ Instead, Musk made a donation to a number of hospitals of ventilation equipment which turned out to be breathing devices more commonly used for treating sleep apnea than those found in intensive care.

• Similarly, in 2018 Musk pledged that he would ‘fund fixing the water in any house in Flint, Michigan that has water contamination above FDA levels.’ After the pledge, his Foundation donated $480,000 to fund water filtration systems in a dozen schools in the city, in a year when his net worth was already $19.9bn. In 2018, the year of his bold pledge to the citizens of Flint, an investigation found Musk had paid no federal income tax.

But for me, Elon is the embodiment of “don’t hate the player, hate the game.” It’s capitalism, it’s the game, with it’s lack of regulation, the emerging market-ification of U.S. financial markets, the weakness of traditional journalism to hold the unconventional to account, and so much more that I hate. I really believe Elon is doing what most entrepreneurs would do, and he’s doing it well. Why stop if no one is stopping you? In that world “move fast and break things” is not over.

So will anything actually change? Well to be perfectly honest I don’t know what is going to happen. I’m not going to predict doom, and I’m not going to predict nirvana. Twitter has both theoretical potential and realized mediocrity, and, after this week in particular, conventional wisdom is that this new future is going to be a disaster with a range of outcomes (as I listed above) which are much wider than they were a few weeks ago. I do wonder if maybe it is just enough to justify Musk’s premium.

The smart take, probably, is “no big change”. The furore over Musk taking over might be misplaced. It is important to remember in social media that the status quo usually wins (particularly when network effects are involved).

Similar skepticism should be applied to other extreme scenarios as well, such as massively positive business outcomes. As Cassandra outlined above, the financing of this acquisition and the necessary cash flow to finance it are … “problematic”. It’s possible that Twitter is just a bad business, and that even more aggressive approaches as I outlined above are unworkable and unsuccessful. That has been the story of Twitter for 16 years now, and should be the null hypothesis.

The same reasoning applies to Musk’s declaration that he is motivated to return Twitter to its free speech roots, and also to defeat spam bots — the reason to list these together is that the latter are examples of free speech, too, which is to say that moderation is hard and complicated, and while Musk may make a difference at the margins, the end result may not end up looking much different.

But all that noted, this is Elon Musk we are talking about. Was it so unreasonable to doubt that the same guy who made electric cars cool and lands rockets on drone ships could come up with $44 billion in funding, even of only to use Twitter as a tool to keep and fortify his $270 billion net worth?

But at the end of the day private ownership of such a powerful instrument as Twitter is probably a bad idea in any case – far worse than merely a concentration of economic power, which led the American government (when it was actually functioning) to impose antitrust legislation on monopolies and other malfactors of great wealth. Twitter, like Facebook (which is even worse) represents a great concentrated social influence and political power. And no individual, least of all one as eccentric, erratic, and socially ill-informed as Elon Musk, should be able to buy power of that magnitude.

One Reply to “Elon Musk, Twitter, the future of disinformation, the economics of social media … and what might really be happening”