[ First draft: work-in-progress ]

Opposites attract: ah, what strange bedfellows the Internet does make.

But is this IBM’s last gasp? “Who Says Elephants Can’t Dance” comes full circle.

2 November 2018 (Paris, France) – There have been a spate of books of late … “Abundance” by Peter Diamandis and Steven Kotler, and “Exponential Organizations” by Salim Ismail, Mike Malone, and Yuri van Geest to name but two … plus lots of media commentary on how certain technologies (like cloud), by virtue of their exponential growth, are reshaping industries like energy generation, communications networks, education delivery and healthcare distribution. We even see it in the e-discovery industry with technologies like compression text analytics plus Python and Pythonista which are totally changing the e-discovery analytical world.

Once a technology became digitized, it became easy to access, share, and distribute. The price for purchasing and deploying technology became so cheap that anybody can have it. And as we all know it has accelerated the use of the cloud. This has resulted in a re-architecture of competitive landscapes.

Which brings us to IBM and Red Hat.

Some background: the deal and the history

Last Sunday (October 28th) IBM announced that it had reached an agreement to buy Red Hat, a premiere U.S.-based provider of open-source software (Linux) products to the enterprise community. The deal will see IBM buying all of Red Hat’s available and outstanding common stock for US$190 per share, in an all-cash transaction worth approximately $34 billion, according to a news release issued on October 28 by IBM.

The acquisition – the largest deal in IBM’s history and reportedly the third-largest ever in the U.S. tech sector – will see IBM paying upward of a 60 percent premium for Red Hat. It had the usual stock market reponse: Red Hat stock rose 49 percent the Monday after the announcement, and IBM stock fell 4.32 percent

NOTE: the term “open source” refers to the source code that a computer program or operating system is originally written in and the fact that the source code is left free and open for anyone to use, peruse and/or modify. Free, open source software (FOSS) is created and modified continually by untold thousand of programmers around the world, working collaboratively over the Internet. FOSS is fundamentally the opposite of the proprietary, closed-source software created by for-profit corporations such as Microsoft and Apple. However, there is nothing to stop the developers of open-source software from trying to make a profit by selling their software and expertise, as Red Hat has succeeded in doing. For-profit computer companies are likewise free to use open-source software – even in proprietary ways. Google, for one, is a past master of using open source for its proprietary purposes.

Red Hat is a major developer of the free, open-source Linux operating system – the operating system that drives the Internet, not to mention Internet routers, web-browsing TVs, refrigerators, Internet-connected thermostats and lightbulbs, as well as most other Internet of things (IoT) devices. In buying Red Hat, IBM is trying (desperately, in my opinion) to strengthen its flagging position as a provider of cloud-based (a.k.a. Internet-based) computing. As of June 2018, IBM was ranked fifth as a cloud provider, behind Amazon, Microsoft, Google, and Alibaba (of all things), which is down from its estimated number three ranking seven months earlier.

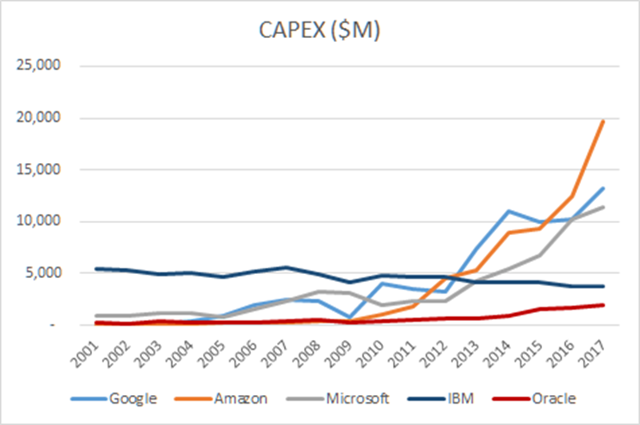

NOTE: as I have written before, IBM’s prior “commitment” to the cloud was mostly an accounting fiction derived from re-classifying existing businesses. The most pertinent number in cloud is a company’s capital expenditures (CAPEX). I will provide more detail on CAPEX below but for the moment suffice it to say that for 2017 IBM’s CAPEX was $3.2 billion, down from 2016’s $3.6 billion. Yes, IBM did finally return to growth earlier this year after 22 straight quarters of decline, only to decline again last quarter. But the numbers tell the tale: IBM’s ancient mainframe business was up 2%, and its traditional services business, up 3%. But Technology Services and Cloud Platforms were flat, and Cognitive Solutions (i.e. Watson) was down 5%. In fact, Watson is a complete fiction, too, but I will save that for a subsequent post.

To say that IBM believes that buying Red Hat will put it on top of cloud computing is putting it mildly. According to Big Blue’s news release, quoting Ginni Rometty, IBM Chairman, President and Chief Executive Officer:

The acquisition of Red Hat is a game-changer. It changes everything about the cloud market. IBM will become the world’s #1 hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their businesses.

Most companies today are only 20 percent along their cloud journey, “renting compute power to cut costs,” she said at the accompanying news conference: “The next 80 percent is about unlocking real business value and driving growth. This is the next chapter of the cloud. It requires shifting business applications to hybrid cloud, extracting more data and optimizing every part of the business, from supply chains to sales”.

That IBM sees the purchase of Red Hat chiefly in terms of growing its cloud computing business is underlined by the fact that its news release announcing the acquisition refers to “cloud” 46 times, “hybrid” or “hybrid cloud” 13 times, “open source” 18 times, and “Linux” a mere four times.

NOTE: “Hybrid cloud“, by the way, refers to a business model in which customers may satisfy some of their cloud computing needs using private computer servers (meaning, their own) and some using servers commercially available to the public (such as Microsoft Azure or Amazon Web Services).

It is important to know that IBM and Red Hat have a long and close history going back to 1999, when IBM committed to use Red Hat Linux on its enterprise hardware and continuing through a variety of open-source partnerships to the present day. [at the end of this post I have “Opposites attract—a brief timeline” which explains all of these overlapping relationships in the industry, provided to me by Nick Bodine of ZDNET who follows cloud]

IBM is a for-profit, proprietary IT company that knows and appreciates open source and Red Hat is an open-source IT company that knows how to make a profit. There should be more synergies between the two than culture clash. We’ll see. The IBM news release gushingly describes the acquisition as bringing “together the best-in-class hybrid cloud providers” and being “the evolution” of the two company’s “long-standing partnership”. By the sounds of it, the pair had to hookup sooner or later. And there’s every reason to believe that the marriage deal will be a win-win for everyone involved. But it certainly looks like a merger to me.

The positives: for Red Hat’s part, it should benefit from a quantum increase in the technical and financial resources needed to advance its long-range plans – going from being an independent company with a public equity of US$1.3 billion (2016) and net income of 258.80 million (2018), to being an independent division of a company with a public equity of $17.5 billion (2017) and net income of $5.7 billion (2017). [Hat tip to Klaus Bering of Bloomberg for the numbers]

And certainly, that is the aspect of the acquisition that Red Hat’s Jim Whitehurst focuses on in the IBM news release:

Open source is the default choice for modern IT solutions, and I’m incredibly proud of the role Red Hat has played in making that a reality in the enterprise. Joining forces with IBM will provide us with a greater level of scale, resources and capabilities to accelerate the impact of open source as the basis for digital transformation and bring Red Hat to an even wider audience—all while preserving our unique culture and unwavering commitment to open source innovation.

IBM’s news release goes to some pains to stress how Red Hat will not be assimilated Borg-like but will function with its identity, independence and character intact, not to mention its “open governance, open source contributions, participation in the open source community and development model…” Said Stewart Bishop (Verge) who also follows cloud:

Upon closing of the acquisition, Red Hat will join IBM’s Hybrid Cloud team as a distinct unit, preserving the independence and neutrality of Red Hat’s open source development heritage and commitment, current product portfolio and go-to-market strategy, and unique development culture. Red Hat will continue to be led by Jim Whitehurst and Red Hat’s current management team. Jim Whitehurst also will join IBM’s senior management team and report to Ginni Rometty. IBM intends to maintain Red Hat’s headquarters, facilities, brands and practices.

IBM also takes the opportunity to stress how much it values open-source software, as well as the expertise that Red Hat brings, both in terms of open-source and cloud computing.

Red Hat’s role in the open-source software movement is foundational, going back 25 years, almost to the beginning of the Linux operating system 27 years ago. And Red Hat maintains a preeminent position as a developer of Linux.

The cloud trend … and the voice of Lou Gerstner dancing in my head

So if the acquisition of Red Hat by IBM looks as much like an inevitable merger (or marriage) of two corporations that have been working and flirting with each other for years, it has to be said that it also looks to be part of a trend.

NOTE: I began my legal career at a Wall Street law firm in 1980 (after three years as a currency trader, then M&A analyst at Solomon Brothers) and IBM was my first client assignment. I have stayed in touch with many IBMers and ex-IBMers through the years, and each year my media team does a video for IBM at the Mobile World Congress (for this year’s video click here).

And Louis Gerstner has a most important part in all of this. He came on board IBM as chairman of the board and chief executive officer in April 1993 until 2002. He is largely credited with turning around IBM’s fortunes. After he left IBM he wrote Who Says Elephants Can’t Dance (published in 2003) which still ranks as one of the best business books ever written, relevant to leaders of both large and small organizations. I have read it at least three times and read it again because he completely nails it when talking about the cloud.

But first, a doozy of a quote.

The best way to understand how it is Red Hat built a multi-billion dollar business off of open source software is to start with IBM. Founder Bob Young explained at the All Things Open conference in 2014:

There is no magic bullet to it. It is a lot of hard work staying up with your customers and understanding and thinking through where are the opportunities. What are other suppliers in the market not doing for those customers that you can do better for them? One of the great examples to give you an idea of what inspired us very early on, and by very early on we’re talking Mark Ewing and I doing not enough business to pay the rent on our apartments, but yet we were paying attention to [Lou Gerstner and] IBM…

Gerstner came into IBM and got it turned around in three years. It was miraculous…Gerstner’s insight was he went around and talked to a whole bunch IBM customers and found out that the customers didn’t actually like any of his products. They were ok, but whenever he would sit down with any given customer there was always someone who did that product better than IBM did…He said, “So why are you buying from IBM?” The customers were saying “IBM is the only technology company with an office everywhere that we do business,” and as a result Gerstner understood that he wasn’t selling products he was selling a service.

He talked about that publicly, and so at Red Hat we go, “OK, we don’t have a product to sell because ours is open source and everyone can use our innovations as quickly as we can, so we’re not really selling a product, but Gerstner at IBM is telling us the customers don’t buy products, they buy services, things that make themselves more successful.” And so that was one of our early insights into what we were doing was this idea that we were actually in the services business, even back when we were selling shrink-wrapped boxes of Linux, we saw that as an interim step to getting us big enough that we could sign service contracts with real customers.

Yep. We come full circle. IBM buys Red Hat.

I have noted in previous posts about Gerstner’s IBM turnaround in the context of Satya Nadella’s attempt to do the same at Microsoft, and Gerstner’s insight that while culture is extremely difficult to change, it is impossible to change nature. Over the weekend I came across Ben Thompson’s Microsoft’s Monopoly Hangover and he has a great observation:

The great thing about a monopoly is that a company can do anything, because there is no competition; the bad thing is that when the monopoly is finished the company is still capable of doing anything at a mediocre level, but nothing at a high one because it has become fat and lazy. To put it another way, for a former monopoly “big” is the only truly differentiated asset. This was Gerstner’s key insight when it came to mapping out IBM’s future … In Gerstner’s vision, only IBM had the breadth to deliver solutions instead of products.

A strategy predicated on providing solutions, though, needs a problem, and the other thing that made Gerstner’s turnaround possible was the Internet. By the mid-1990s businesses were faced with a completely new set of technologies that were nominally similar to their IT projects of the last fifteen years, but in fact completely different. Gerstner described the problem/opportunity in Who Says Elephants Can’t Dance:

If the strategists were right, and the cloud really did become the locus of all this interaction, it would cause two revolutions — one in computing and one in business. It would change computing because it would shift the workloads from PCs and other so-called client devices to larger enterprise systems inside companies and to the cloud — the network — itself. This would reverse the trend that had made the PC the center of innovation and investment — with all the obvious implications for IT companies that had made their fortunes on PC technologies.

Far more important, the massive, global connectivity that the cloud depicted would create a revolution in the interactions among millions of businesses, schools, governments, and consumers. It would change commerce, education, health care, government services, and on and on. It would cause the biggest wave of business transformation since the introduction of digital data processing in the 1960s…Terms like “information superhighway” and “e-commerce” were insufficient to describe what we were talking about. We needed a vocabulary to help the industry, our customers, and even IBM employees understand that what we saw transcended access to digital information and online commerce. It would reshape every important kind of relationship and interaction among businesses and people. Eventually our marketing and Internet teams came forward with the term “e-business.”

Those of my readers who are “of a certain age” will well remember what soon became IBM’s ubiquitous ‘e’:

I have spent a fair amount of time studying the history of IBM, and the history of the cloud, but space prevents me from providing a lot of details. But here is the key thing. The IBM strategy worked because it was true: large enterprises, most of which had only ever interacted with customers indirectly through a long chain of wholesalers and distributors and retailers suddenly had the capability — the responsibility, even — of interacting with end users directly. This could be as simple as a website, or e-commerce, or customer support, not to mention the ability to tap into all of the other parts of the value chain in real-time. The technology challenges and the business possibilities — the problem set, if you will — were immense, and Gerstner positioned IBM as the company that could solve these new problems.

And it was an attractive proposition for nearly all non-tech companies. As Ben Thompson pointed out in an IBM piece a few years ago:

The challenge with the Internet in the 1990s was that the underlying technologies were so varied and quite immature; different problem spaces had different companies hawking products, many of them startups with no experience working with large enterprises, and even if they had better products no IT department wanted to manage and integrate a multitude of vendors. IBM, on the other hand, offered the proverbial “one throat to choke”; they promised to solve all of the problems associated with this new-fangled Internet stuff, and besides, IT departments were familiar and comfortable with IBM.

The actual technologies underlying the Internet were open and commoditized, which meant IBM could form a point of integration and extract profits, which is exactly what happened: IBM’s revenue and growth increased steadily over the next decade, as the company managed everything from data centers to internal networks to external websites to e-commerce operations to all the middleware that tied it together (made by IBM, naturally, which was where the company made most of its profits). IBM took care of everything, slowly locking its customers in … but once again grew fat and lazy.

When IBM Lost the Cloud

In the final paragraph of Who Says Elephants Can’t Dance? Gerstner wrote of his successor Sam Palmisano:

I was always an outsider. But that was my job. I know Sam Palmisano has an opportunity to make the connections to the past as I could never do. His challenge will be to make them without going backward; to know that the centrifugal forces that drove IBM to be inward-looking and self-absorbed still lie powerful in the company.

Palmisano failed miserably. He was fond of saying that product cycles aren’t going to drive sustainable growth. Clients in the future will demand quantifiable returns on their investment. They are not going to buy fashion and trends. And the doozy: “Enterprise will have its own unique model. You can’t do what we’re doing in a cloud”.

Yep. As Brad Stone notes in his book The Everything Store: Jeff Bezos and the Age of Amazon (still the definitive story about Amazon):

Amazon Web Services, meanwhile, had launched a full four years and two months before Palmisano’s declaration; it was the height of folly to not simply mock the idea of the cloud, but to commit to a profit number in the face of an existential threat that was predicated on spending absolutely massive amounts of money on infrastructure.

Simply put: Gerstner identified exactly what it was that Palmisano got wrong: he was “inward-looking and self-absorbed” such that he couldn’t imagine an enterprise solution better than IBM’s customized solutions. The reality is that the businesses IBM served – and the entire reason IBM had a market – didn’t buy customized technological solutions to make themselves feel good about themselves; they bought them because they helped them accomplish their business objectives. Gerstner’s key insight was that many companies had a problem that only IBM could solve, not that customized solutions were the end-all be-all. And so, as universally provided cloud services slowly but surely became good-enough, IBM no longer had a monopoly on problem solving.

And now IBM has spent the years since then claiming it is committed to catching up in the public cloud, but the truth is that Palmisano sealed the company’s cloud fate when he failed to invest a decade ago:

What you see here is IBM’s CAPEX slowly trailing off, like the company itself. IBM has always spent a lot on CAPEX (as high as $7 billion a year in their more glorious past), from well before the cloud era, so we can’t assume the absolute magnitude of spend is going towards the cloud. The big three all surpassed IBM’s CAPEX spend in 2012/13. In resisting the upward pull on CAPEX we see from all the other cloud vendors, IBM simply isn’t playing the hyper-scale cloud game.

Indeed, one of the most important takeaways from the Red Hat acquisition is the admission that IBM’s public cloud efforts are effectively dead.

The point of IBM acquiring Red Hat … and what it has to do with Lou Gerstner

This is where the Red Hat acquisition comes in: while IBM will certainly be happy to have the company’s cash-generating subscription business, the real prize is Openshift, a software suite for building and managing Kubernetes containers. As Ben Thompsn wrote about Kubernetes in a long piece How Google is Challenging AWS:

In 2014 Google announced Kubernetes, an open-source container cluster manager based on Google’s internal Borg service that abstracts Google’s massive infrastructure such that any Google service can instantly access all of the computing power they need without worrying about the details. The central precept is containers, which I wrote about in 2014: engineers build on a standard interface that retains (nearly) full flexibility without needing to know anything about the underlying hardware or operating system (in this it’s an evolutionary step beyond virtual machines).

Where Kubernetes differs from Borg is that it is fully portable: it runs on AWS, it runs on Azure, it runs on the Google Cloud Platform, it runs on on-premise infrastructure, you can even run it in your house. More relevantly to this article, it is the perfect antidote to AWS’ ten year head-start in infrastructure-as-a-service: while Google has made great strides in its own infrastructure offerings, the potential impact of Kubernetes specifically and container-based development broadly is to make irrelevant which infrastructure provider you use. No wonder it is one of the fastest growing open-source projects of all time: there is no lock-in.

And that is exactly what IBM is counting on; the company wrote in its press release announcing the deal:

This acquisition brings together the best-in-class hybrid cloud providers and will enable companies to securely move all business applications to the cloud. Companies today are already using multiple clouds. However, research shows that 80 percent of business workloads have yet to move to the cloud, held back by the proprietary nature of today’s cloud market. This prevents portability of data and applications across multiple clouds, data security in a multi-cloud environment and consistent cloud management.

IBM and Red Hat will be strongly positioned to address this issue and accelerate hybrid multi-cloud adoption. Together, they will help clients create cloud-native business applications faster, drive greater portability and security of data and applications across multiple public and private clouds, all with consistent cloud management. In doing so, they will draw on their shared leadership in key technologies, such as Linux, containers, Kubernetes, multi-cloud management, and cloud management and automation.

This is the bet: while in the 1990s the complexity of the Internet made it difficult for businesses to go online, providing an opening for IBM to sell solutions, today IBM argues the reduction of cloud computing to three centralized providers makes businesses reluctant to commit to any one of them. IBM is betting it can again provide the solution, combining with Red Hat to build products that will seamlessly bridge private data centers and all of the public clouds.

CONCLUSION: IBM’s Unprepared Mind

The best thing going for this strategy is its pragmatism: IBM gave up its potential to compete in the public cloud a decade ago, faked it for the last five years, and now is finally admitting its best option is to build on top of everyone else’s clouds. That, though, gets at the strategy’s weakness: it seems more attuned to IBM’s needs than potential customers. After all, if an enterprise is concerned about lock-in, is IBM really a better option? And if the answer is that “Red Hat is open”, at what point do increasingly sophisticated businesses build it themselves?

The problem for IBM is that they are not building solutions for clueless IT departments bewildered by a dizzying array of open technologies: instead they are building on top of three cloud providers, one of which (Microsoft) is specializing in precisely the sort of hybrid solutions that IBM is targeting. The difference is that because Microsoft has actually spent the money on infrastructure their ability to extract money from the value chain is correspondingly higher; IBM has to pay rent.

Which takes me back to Gerstner: before IBM could take advantage of the Internet, the company needed an overhaul of its culture; the extent to which the company will manage to leverage its acquisition of Red Hat will depend on a similar transformation. Unfortunately, that seems unlikely; current CEO Ginni Rometty, who took over the company at the beginning of 2012, not only supported Palmisano’s disastrous Roadmap 2015, she actually undertook most of the cuts and financial engineering necessary to make it happen, before finally giving up in 2014. Meanwhile the company’s most prominent marketing has been around Watson, the capabilities of which have been significantly oversold; it’s not a surprise sales are shrinking after disappointing rollouts. I’ll finish with Charles Fitzgerald who writes on Platformonomics:

Gerstner knew turnarounds were hard: he called the arrival of the Internet “lucky” in terms of his tenure at IBM. But, as the Louis Pasteur quote goes, “Fortune favors the prepared mind.” Gerstner had identified a strategy and begun to change the culture of IBM, so that when the problem arrived, the company was ready.

Today IBM claims it has found a problem; it is an open question if the problem actually exists, but unfortunately there is even less evidence that IBM is truly ready to take advantage of it if it does.

Opposites attract—a brief timeline

1998: Mark Andreesen—having gotten filthy rich off of his Netscape web browser(based on the government-funded NCSA Mosaic browser he helped develop)—gets out before Microsoft can crush him with its monopolistic promotion of Internet Explorer. Andreesen makes the Netscape source code public and sets up the Mozilla foundation to develop it, leading directly to the creation of the open-source Firefox web browser.

1999: IBM agrees to promote the use of Red Hat Linux on its proprietary hardware.

2001: A year into his job as Microsoft’s buffoon-of-a-CEO, Steve Balmer, publicly calls “Linux a cancer“, beginning a classic campaign of sowing fear, uncertainty, and doubt (FUD) about open source software.

2001: Steve Jobs returns to Apple, bringing with him the operating system he created for NeXT, his second computer company. The NeXTSTEP OS, partially based on the open-source OS FreeBSD, becomes OS X, the new operating system of Apple Macintosh computers and later the basis of iOS.

2003: Hoping to revive its fading fortunes, software giant Novell purchases Ximian, a developer of open-source Linux apps, then spends US$210 million to buy SUSE, a German-based multinational pioneer in Linux sales and services to enterprise.

2004: The Mozilla Foundation releases version 1.0 of Firefox, its highly-anticipated open-source web browser.

2004: Ubuntu Linux patron, CEO of Canonical, and space shuttle passenger Mark Shuttleworth famously issues Ubuntu’s Bug Report #1: “Microsoft has a majority market share in the new desktop PC marketplace. This is a bug which Ubuntu and other projects are meant to fix.”

2005: Novell spins off the openSUSE Project as an arm of the commercial SUSE, to develop the free openSUSE version of Linux.

2005: Google buys the Android operating system and refashions the proprietary, closed-source OS using a core of open-source Linux.

2008: Google begins the open source Chromium web browser project to serve as a development test bed for the proprietary, closed source Chrome browser.

2009: JasperSoft (acquired by Tibco Software, 2014) and Talend, open-source providers of business intelligence (BI) software and data services, partner with two proprietary vendors: Vertica (analytic databases) and RightScale (cloud services) to deliver BI for clouds, triggering angst in at least one-open source blogger.

2010: in March, software maker Attachmate acquires Novell (and SUSE) for US$2.2 billion.

2013: Developers of Fuduntu, a popular distribution of Linux, call it quits after bullying from other developers, partly because the distro’s portmanteau name—combining Fedora and Ubuntu (two Linux flavours)—is seen to be in bad taste. It brings to mind Microsoft’s ugly “FUD” campaign against the FOSS community.

2013: Mark Shuttleworth closes Ubuntu’s Bug Report #1 because, well, Windows is still easier to use than Ubuntu and thanks to Android (basically the easy-to-use Linux) Google now has a way bigger majority market share than Microsoft.

2013: One of the organizers of the 2013 Future of Cloud survey declares that “open source is eating the software world” by driving the innovation in cloud, Big Data, and mobile.

2014: in September, mainframe software maker Micro Focus buys the Attachmate Group (including Novell and SUSE) for US$1.2 billion.

2016: Pigs are seen to fly as Microsoft—formerly the most vituperative enemy of open source software—becomes a Platinum Member of the Linux Foundation—the guiding organization of Linux.

2016: Towing the new party line, former Microsoft CEO Steve Ballmer tells the media that he no longer thinks Linux is a “malignant cancer”.

2016: Canonical, the commercial patron of Ubuntu Linux, partners with Microsoft to bring native command-line Ubuntu Linux to Windows 10.

2017: Security experts are shocked to discover that Intel processors (which power the majority of desktop/laptop computers) have been running their own insecure version of the open-source MINIX operating system—a 1980s Unix-like OS which famously inspired the creation of Linux.

2018: Microsoft announces its first Linux operating system: the Microsoft Azure Sphere platform, for its cloud services.